🔹 What Is Multilevel Accounts Group (Part by Part Ledger)?

Multilevel Accounts Group (Part by Part Ledger) is a powerful and flexible way to organize financial transactions and account heads in a systematic and hierarchical structure. It plays a key role in modern accounting by allowing businesses to break down their accounts into more granular components. Instead of lumping all transactions under a single Ledger, multilevel grouping lets you create a “Ledger within Ledger”—forming a rich, multilayer view of financial data.

This approach makes it much easier for companies to track, manage, and report financial transactions accurately and efficiently, especially when their operations become more complex.

🔹 Why Is It Important?

Every business has numerous transactions happening daily. If we were to put all transactions into a single Ledger, it would become messy and challenging to interpret. A multilevel account structure lets you separate transactions into logical groups and subgroups.

This way, you can quickly view financial details at different levels — from a broad “Assets” or “Liabilities” view down to a specific “Cash in Bank” or “Accrued Expenses — Rent” account.

Such a framework not only assists in clear financial reporting but also in decision-making, financial analysis, and internal controls.

🔹 How It Works

Picture multilevel accounts as a tree-like structure.

At the top, you have a Primary Ledger Group — for example, “Assets.”

This primary group may have several Secondary Ledger Groups, such as “Current Assets” and “Non-Current Assets.”

Then, each secondary group can have Tertiary Ledger Groups, like “Cash and Cash Equivalents” or “Inventory.”

Finally, at the leaf level of this structure, you have Individual Ledger Accounts, which track transactions directly.

For “Cash and Cash Equivalents”—this might include Petty Cash, Bank A, and Bank B.

🔹 Advantages of Multilevel Ledger

✅ Cleaner Organization:

Your financial transactions are neatly classified under appropriate heads.

✅ Easy Reporting:

With multilevel grouping, you can generate reports at a summary or detailed level with a few clicks.

✅ Scalable:

As your business grows and transactions become more complex, you can simply add additional groups or subgroups.

✅ Accurate Analysis:

Provides a clear view of financial health at different depths — from a department, account, or enterprise level.

✅ Simplified Audits:

Auditors can easily navigate through your accounts, reducing confusion and saving time.

🔹 Examples of Multilevel Ledger Group

Let’s say we have a business with numerous transactions.

Using multilevel grouping, we might structure their Ledger as follows:

➥ Assets (Primary)

- Current Assets (Secondary)

- Cash and Cash Equivalents (Tertiary)

- Petty Cash

- Bank A

- Bank B

- Inventory

- Raw Materials

- finished goods

- Cash and Cash Equivalents (Tertiary)

- Non-Current Assets (Secondary)

- Property, Plant, and Equipment (Tertiary)

- Machinery

- Vehicles

- Land

- Property, Plant, and Equipment (Tertiary)

➥ Liabilities (Primary)

- Current Liabilities (Secondary)

- Accounts Payable

- Short-Term Loans

- Non-Current Liabilities (Secondary)

- Long-Term Debt

- Pension Liabilities

➥ Equity (Primary)

- Share Capital

- Retained Earnings

➥ Income (Primary)

- Operations

- Other Income

➥ Expenses (Primary)

- Cost of Goods Sold

- administrative expenses

- selling expenses

Voucher

What is Multilevel Accounts Group?

Track multiple organizational segments such as companies, business units, or profit centers. Hierarchy of departments can be consolidated by levels for summary purposes. Financial data can be viewed at various levels of the overall business hierarchy.

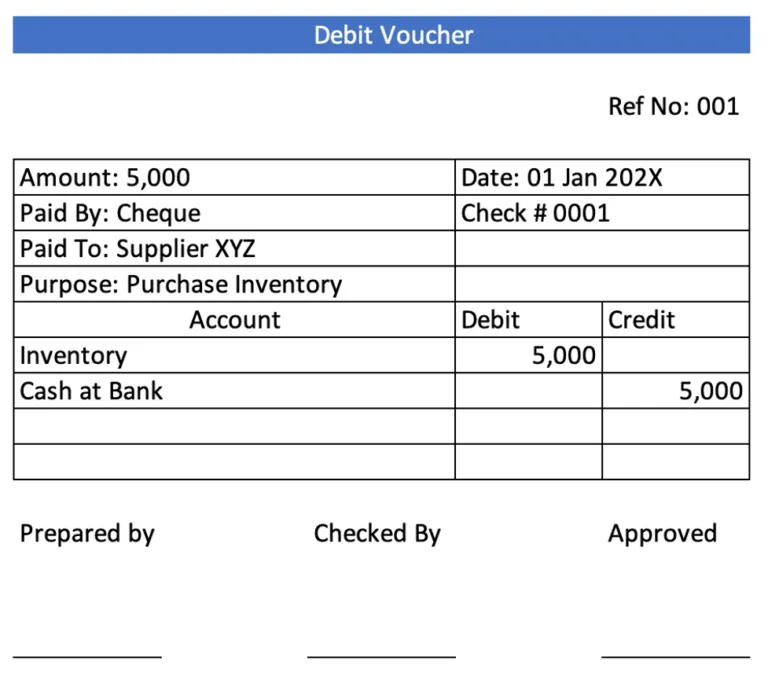

Bank Debit Voucher?

A debit voucher or payment voucher is the supporting document that shows that the monetary transaction has occurred.

Bank Credit voucher?

A credit Voucher is a document that records accounting transactions and contains monetary value including cash payments when payment is made.

Cash Debit Voucher?

Debit vouchers are the documentary evidence of cash payments.

Cash Credit Voucher?

Credit vouchers are the documentary evidence of Cash receipts.

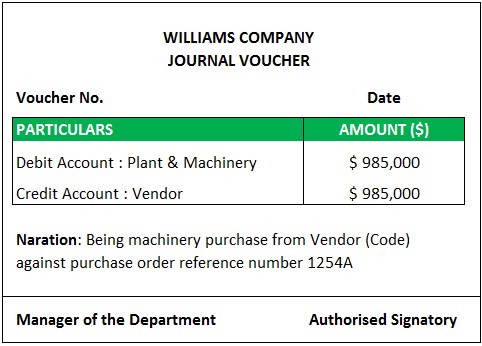

Journal Voucher?

A journal voucher is a written authorization to make a transaction entry, and so is a key document that is examined by auditors as part of their audit procedures.

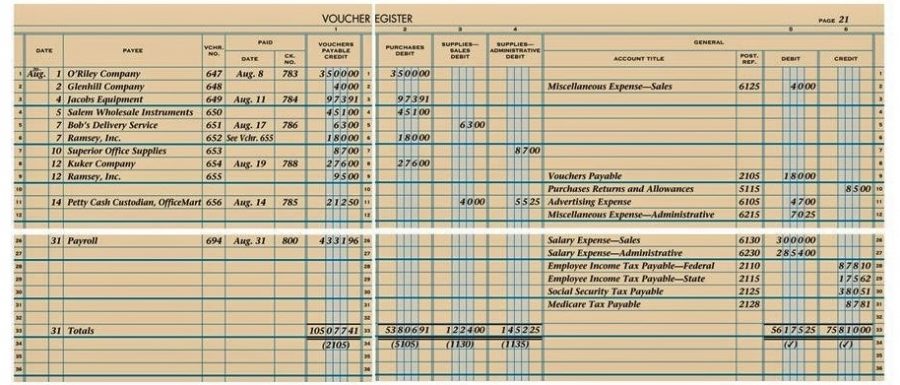

Voucher Register?

The voucher register is a journal that records all vouchers once they are approved. Sometimes the voucher register is called the book of original entry because all the vouchers are entered into the voucher register before they are entered into any other part of the accounting system.

If you’d like me to proceed with any of these, please just let me know from the site techtweet.xyz! Also if you need to learn something new than subscribe YouTube : ASP.NET With SQL SERVER