LC (Letter of Credit)

The Letter of Credit Process

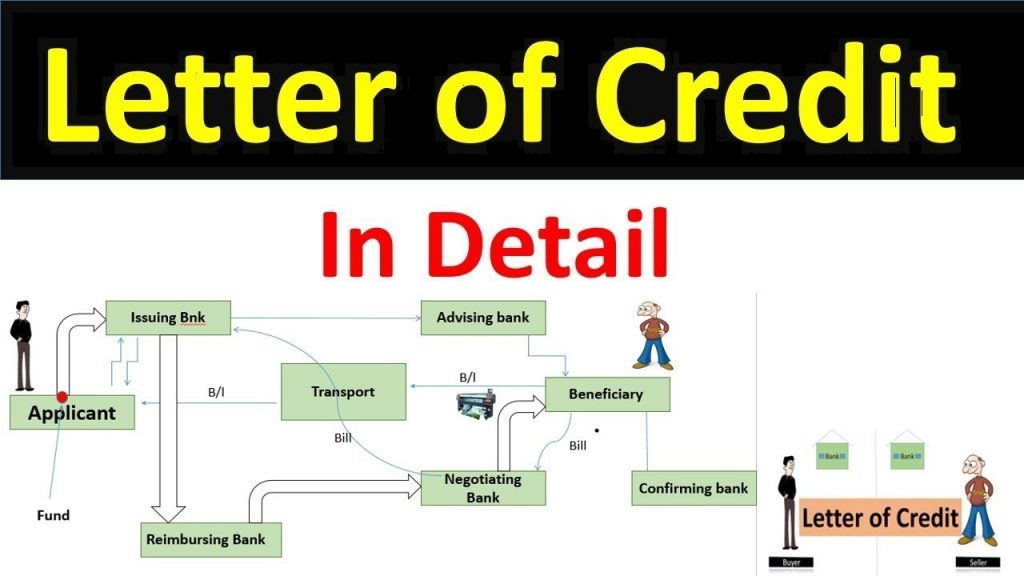

The importer arranges for the issuing bank to open an LC in favor of the exporter. The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter. The exporter forwards the goods and documents to a freight forwarder.

What is LC (Letter of Credit) requirements?

A Letter of Credit (LC) is a document that guarantees the buyer’s (importer) payment to the sellers (exporter). It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

Why is LC necessary?

Letters of credit are indispensable for international transactions since they ensure that payment will be received. Using documentary letters of credit allows the seller to significantly reduce the risk of non-payment for delivered goods, by replacing the risk of the buyer with that of the banks.

What is LC acceptance?

L/C Acceptance means an outstanding bill of exchange drawn by the beneficiary of a documentary L/C and which CIBC has accepted and is therefore obligated to pay at maturity.

Who is negotiating bank in LC?

Negotiating Bank: The Negotiating Bank is the beneficiary’s bank. The beneficiary in an LC transaction would be the seller or exporter. The negotiating bank would claim payment from the issuing bank or the opening bank.

What is LC draft?

LC Draft means a draft drawn on an Issuing Bank pursuant to a Letter of Credit. … LC Draft means a draft drawn on an Issuing Bank pursuant to a Letter of Credit.

Who opens LC importer or exporter?

The importer arranges for the issuing bank to open an LC in favor of the exporter. The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter. The exporter forwards the goods and documents to a freight forwarder.

What is LC validity period?

LC expiry date means the last date to submit the exported documents with bank for negotiation of documents. … Means, Letter of Credit is void if shipped goods before the date mentioned in LC for shipment, but not submitted documents for negotiation within the validity period of Letter of Credit.

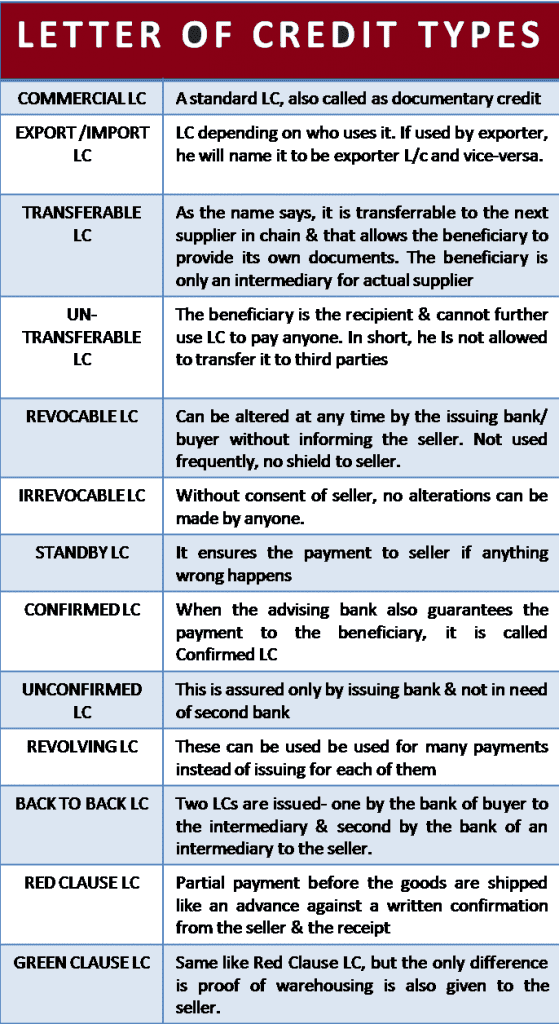

How many types of LC are there?

They are Commercial, Export / Import, Transferable and Non-Transferable, Revocable and Irrevocable, Stand-by, Confirmed, and Unconfirmed, Revolving, Back to Back, Red Clause, Green Clause, Sight, Deferred Payment, and Direct Pay LC.

If you’d like me to proceed with any of these, please just let me know from the site techtweet.xyz! Also if you need to learn something new than subscribe YouTube : ASP.NET With SQL SERVER